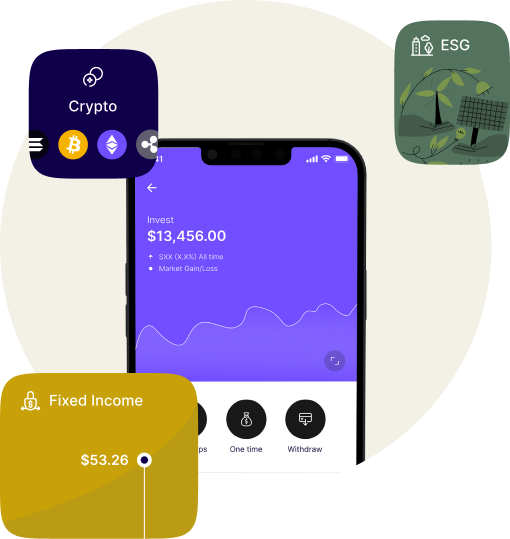

Assets & Strategies we support

We use a wide variety of assets and strategies customized to meet individual client needs

Get a portfolio that's invested in you.

Equities

We support global equity strategies across US, International Developed, and Emerging Markets, across the Large and Mid-Capitalization, Small Cap spaces.

Read More

Fixed Income

We can help build tracking portfolios across the Government, Investment Grade and High Yield universe for US fixed income instruments.

Read More

Multi-Asset

We can help create replicating portfolios across multiple assets such as a mix of Equities, Fixed Income, and Crypto customized to meet individual risk return needs. Some traditional Examples are 60/40- 60% equities and 40% Fixed Income

Crypto

Getting direct exposure to crypto currencies can be a challenge for traditional investors. We can help demystify the space and for investors can help get

Read More

ESG

A portfolio should be you and express your views and beliefs, we work with major index providers and ESG data providers and can advise on how best to

Read More

Factor Based Investing

Factor investing is nothing short of a revolution on how to think about the forces that move markets and to structure your portfolio, across a “standard” local

Read More